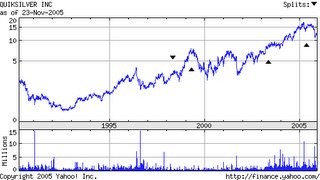

Quiksilver

ZQK

Quiksilver, not quicksilver (no c). $12.35 on 11/23/05.

This company is well known. One of it's biggest team surfers/riders Is Kelly Slater. He recently won another world championship. Go Kelly... Tear it up....

The Quiksilver snowboard team includes Todd Richards , who was 16th the first olympic snowboarding halfpipe contest, and 1st in the 2001 slopestyle.

For the girls, there is Roxy .

I love a surfer girl, and Roxy works for good birthday and Christmas gifts. For the boarders, Rossignol is their subsidiary, but I think it's clear private Burton Snowboards has it locked up. Other subs: Dynastar, Cleveland Golf clubs, Gnu (I like Gnu boards)

The company is also champ in my eyes. They got a little backhanded the other day by Jim Cramer, but they put shoes on my feet (DC shoes) and baggies on my backside. I think this is the biggest public alternative sport brand besides Billabong, which I think just started public trading on the austailian exchange a year ago.

Billabong Fpo 12.97 AU 11/23/05

ASX:BBG

Australian Stock Exchange

Volcom (VLCM) has seen a price jump, but since it is an ipo and brand names are fickle (besides the top dog) I would wait it out for a while.....

The biggest thing that makes me prefer this older company, besides zqk's consitant Kelly Slater performance, is a positive attitude.

The Quiksilver Foundation does it all. Cool Man...

Some Finance: they made $99 million on $1.5 billion in sales.

p/e = 15

They have better than industry ratios and although very cyclical, good growth.

That's it then.

0 Comments:

Post a Comment

<< Home