BP

BP ... Can an environmentally concerned investor buy a huge oil company? Sure---If BP is going to make money anyway, they might as well pay me (an investor) part of their profits. BP's dividend is good ( 2.14 and possibly 3 next year) They are growing...... net income (profits) grew at about 6%, even though growth estimates for revenues are about 11%... profits are 6% on $316 billion... wow, that should be nice to take part in. Enough said about the solid business....

...It's the future I'm worried about

Doubt CO2's effect on the environment? BP doesn't (unlike some others).

They have a whole web site dedicated to the future sustainability of energy and the environment .

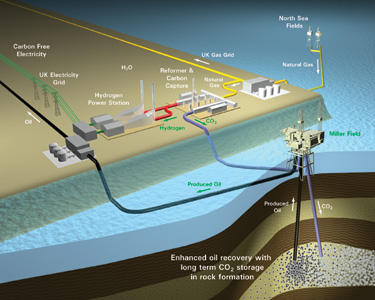

1) decarbonized fuels ....or turning Natural Gas or Oil into hydrogen !!! .... H2 future...one day...one day....

2) BP Solar: They sell at Home Depot complete systems .... WholeFoods (WFMI) BP Solar CASE STUDY

Solar Costs are initially higher than costs can be recovered in five years.... are they woth it? Step in the Government to help the market have a little forsight and planning...

Tax benifit in your area:

National database for renewable tax incentives:

http://www.dsireusa.org/index.cfm

nc state tax credit site

• A maximum of $3,500 for residential active space heating, combined active space and domestic hot water systems, and passive space heating;

• A maximum of $1,400 for residential solar water heating systems, including solar pool heating systems;

• A maximum of $10,500 for photovoltaic (solar electric), wind, or other renewable energy systems for residential use;

• A maximum of $250,000 (increasing to $2,500,000 for 2006 through 2010) for all solar, wind, hydro and biomass applications on commercial and industrial facilities, including photovoltaic, daylighting, solar water and space heating technologies.

Renewable energy equipment costs eligible for the tax credit include the cost of the equipment and associated design, construction costs and installation costs less any discounts, rebates, advertising, installation assistance credits, name referral allowances or other similar reduction

0 Comments:

Post a Comment

<< Home