Solar Heated Stocks

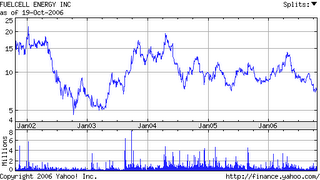

Soar Panel Makers have seen some extreme moves. As an environmentalist I am happy the industry is getting support, but as an investor and a person whose dreams with fuel cells disappeared, I am mighty apprehensive.... consider First Solar's (FSLR) P/E of over 500 . Can a company grow into that revenue stream with out difficulty? They are hirining and profitable :)

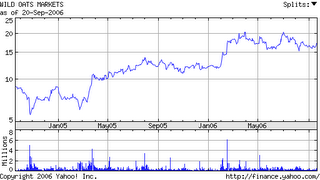

Chinese solar companies? (The Wall Street Journal Comment) Trina Solar (TSL) Can anyone be sure about their revenues? C'mon they all start promising and burn up in the light. See China Sun Energy for a marketing scam....( CSUN).... And what Jim Cramer's favorite Sun Power SPWR? They make a $400 million on $5 billion in market cap... (at least SPWR has very little debt and is making revenue)

First Solar, (FSLR) around since 1999 is making thin film technology. FSLR shot up 23% for announcing they may have orders...geee.....

Remember BP Solar , Siemens, and Kyrocera actually make money in the solar game ....and no doubt research thin film and nano technology. Will they buy technology or just out spend and crush the little newcomers? I am sure the latter is the case.

Evergreen Solar (ESLR) has not moved in years, and is not profitable although selling in retail stores with BP and Siemens. Adding thin film solar to windows hasn't made much for penny stock XsunX (http://finance.yahoo.com/q?d=t&s=XSNX.OB)

How about this Sun: Sun Microsystems SUNW http://finance.yahoo.com/q?s=SUNW because I live near them.

Others in the sun gold rush:

Solarfun (SOLF) and Suntech Power (STP ), JA Solar (JASO ) and Canadian Solar (CSIQ )