Growing OATS

I have finally visited my first Wild Oats Market in Louisville Kentucky and I was very impressed. I have driven past Harry’s (a Whole Foods Store) in Alpharetta Georgia, where Alton Brown chief/scientist from Food TV’s “Good Eats,” is continually shooting episodes. He totally advertises the store, which he uses to explain what Quality is.

What is driving the growth of Markets like Whole Foods (WFMI) and Wild Oats? Healthy and educated living styles are more common. Wal-Mart’s newness and wonderland of cheap everything is deterring crowd and conscious leery middle income buyers. There are quality food sections in Kroger and other chains…so why are these chains growing so popular? Is it their interior atmosphere? Assured quality, because the management seems to share similar beliefs? Probably.

Details:

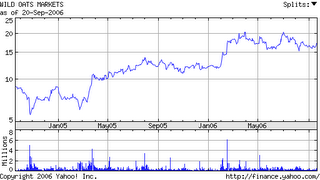

OATS (around since the 70’s from Colorado) is up 36% for the year and made $.37 per share net income. Other Financial also look good, except a large amount of debt, which, although typical for a growing company and a good use of stock holder capital, can lead to growing pains. Over 26% of OATS shares are held by insiders which can reduce volatility.

Whole Foods appears to have better financials such as a positive Return on Assets (Oats is negative) earns $1.20 per share…Note: WFMI growth is much less now as they have entered many suburban markets. OATS also has a Negative Operating Margin! They are better at managing inventory (+) but spending lots of money. Also Depreciation is a large part of cash flows which will lower (lower operating cash flow in) as equipment ages….of course spending on equipment will also lower because refridgerators and trucks do last a while after fully depreciated.

OATS seems to have sustainable growth. OATS does not seem overly eager to start new stores and compete like drug stores CVC and Walgreens. They pop up stores that may loose money just to force the competitor out.

Check out finance.google.com for a hyperactive chart that can show trading trends.

Trends are trends, but it is Management and Business Strategy that make long term Buys. Whole Foods managers are serious and good. They are businessmen, not hippies in business. OATS managers seem to be less hardcore but more good spirited. They pay their lower employees more, less aggressive negotiators for rental space, (opinion from news articles), and contribute more to the environmental community.

This separates them from the Kroger chains that have a natural section. Wild Oats, may be up there with whole foods if new big eyed managers come in.

0 Comments:

Post a Comment

<< Home