Big VeraSUN (VSE) & Aventine Summer Fuels IPOs

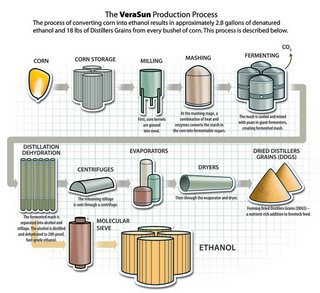

Say no to ethanol. Ethanol will ruin our crop land, and the farmer will not benifit as much as the fertilizer industry. VeraSun and Aventine (Avr) are the latest IPOs in the ethanol industry and are very similar businesses. They are chemicals companies that make ethanol and feed stock.

Aventine is the more profitable of the two and has been around years longer. Their revenue is just over $1 billion, with revenue at $30 per share-- positive. EPS is $1 so there must be significant costs in operating the business. Just to compare businesses, the top owners make around $200k/ year and there is less debt with a better cash flow per share. So I beleive it is run better than VeraSUn ( Opinion)

Verasun opened at $29, it dropped to $26 and Aventine dropped from $42 to $39. VeraSun has a 2 billion dollar market cap and has only $300 million in revenues....The IPO has served the company weel, but how is going to expand and use all that new cash? The top three employees make over $500k a year. It is expected to grow 62% per and although eps is $.03 it is profitable which is better than many other investments. They also have very little debt ($200 millin).

I would advise buying BP stock any since they supply petroleum for tractors fertilizers, and the natural gas used to turn grain into ethanol.

Ethanol is not environmentally freindly.

I would rather build nuclear plants than have our food plants diverted to cars. The current push to expand the ethanol market is to get the Mid West corridor to sell E85 and in fortmation about ethanol projects are avilable at both companies' web sites.

Let's think about this alternative energy thing and not let ADM and Cargill fight or conspire to decide our future.

0 Comments:

Post a Comment

<< Home