Fuel Cells and Big Oil ( FCEL vs. BP )

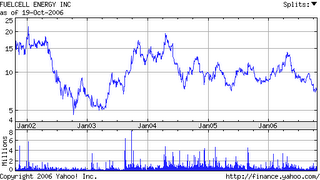

Could these two live in the same portfolio? Idealism aside, they probably should. Over the next month or so, oil will wane as will alternative energy. But idealism will kick in around November making it a good time to buy Fuel CEll Energy . Seasonally November is good for FCEL. Goto Google chart pagee for FCEL and look at the November though january segment. It rises in the fall, and fals in the spring...every year it seems....

Oil companies do make money, and it may be good for your retirement if you make money. Many of my friends get upset when I decide to recommend they get BP and maybe CRT to add income and stability to their future. Neither are going to rocket up, but they are not going down, unless something big happens which will knock everything else down too.

So my philosophy is that BP is trying to be a good big oil company, but they still have to be a big dog in a dog eat dog industry. CRT earns an incredible 8% yield, which over the long run is a very good return for the lack of risk.

FCEL Fuel Cell energy gives the portfolio some green goodness. The company’s technology can be over run by Seimens or better yet, if their patents hold out (which are aging) they may get bought. As much as I want FCEL to take over the distributed energy market, I’d bet GE could enter at any time and take over when profits are actually there.

I like battery technology and other power companies to add to the energy mix. Idaho Power (IDA) makes fuel cells and is a dividend paying utility whose stock does not move. Dividends are like the stock moving up though! Battery makers are tricky? Toshiba? Panasonic? Who makes the chemical separators for the batteries in power tools?

Any of these can be a stabilizer in a market that is full of stocks with incredibly high PE’s and uncertain futures.