Pacific Ethanol

PEIX

good link to ethanol production

News says Bill Gates is buying this company

3.5 times more cash than debt.

Revenues = $555,000

Market cap = $309 million.

Archer Daniels Midland is a major obstacle. So is Cargill (giants). Both are known to have influence on price and politics. Also, Land-O-Lakes makes ethanol from cheese whey.

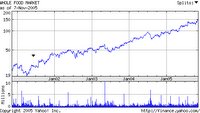

(ADM stock price)

ADM describes ethanol business

Dept of Energy on Ethanol

Ethanol comes from corn or soybeans, which are mostly used for feed ( corn is about 80%). So the price of ethanol will likely be a balance between feed prices and gas. I do not favor biofuels longterm....They will one day compete for food resources, and affect water supplies and unsustainable farming with high levels of chemicals.

However, some places in the northwest use wood or brewery waste to make ethanol.

In the short term, ethanol is already being used in gas since it can be cheaper. It can also lower gas prices because it is a cleaning agent, a replacement for other additives to make gas meet emissions requirements.

PS

ADM is on my not cool list for price fixing .